Finance

N606 billion Was Shared Among Nigerian Govt, States And local Councils For April.

N606 billion Was Shared Among Nigerian Govt, States, And local Councils For April.

N606 billion was shared among Nigerian govt, states, and local councils on Friday as federal allocation for the month of April 2020.

At the end of the online meeting of the Federal Accounts Allocation Committee (FAAC) in Abuja, the details of the allocation were contained in a Secretariat report released by the office of the Accountant General of the Federation.

Mahmoud Isa-Dutse, the Permanent Secretary, Federal Ministry of Finance, Budget, and National planning presided the meeting.

The communique showed the allocation included revenue from the Value Added Tax (VAT) collection, Exchange Gain, Solid Mineral Revenue, Excess Bank Charges, and Excess Crude Oil Revenue.

The breakdown of the allocations showed the federal government received about N169.831 billion, the states N86.140 billion, local government councils N66.411 billion, while the oil-producing states received N32.895 billion as derivation (13 percent Mineral Revenue).

The report said the cost of collection for the Federal Inland Revenue Service (FIRS), Department of Petroleum Resources (DPR), and Nigeria Customs Service (NCS) Refund; as well as allocation to the North East Development Commission and Transfer to Excess Oil Revenue was N15.134 billion.

ALSO READ:

- PRESS RELEASE – 2019 Financial Record of Nigeria Customs Service

- Ex-DCG: Customs gain is being destroyed by Politics

- New Order: CBN Raises Exchange Rate For Cargo Imports (326 ->361)

The Federation Accounts Allocation Committee (FAAC) said the gross revenue available from the Value Added Tax (VAT) for the month was about N94.495 billion as against the N120.268 billion distributed in the preceding month, a decrease of about N25.772 billion.

The distribution showed the federal government got N13.182 billion, the states N43.941 billion, while local government councils got N30.758 billion.

The distributed Statutory Revenue of N370.411billion received for the month was lower than the N597.676 billion received for the previous month by about N227.265 billion.

This showed a predicted trajectory of decline in revenue accrual as a result of the continued ravaging impact of the coronavirus pandemic on the global economy, particularly the international crude oil market.

The communique also revealed that Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Import and Export Duties, Oil and Value Added Tax (VAT), all recorded decreases.

No details of the decreases were provided in the communique.

The total revenue distributable for the current month (including the cost of collection to NCS, DPR, and FIRS) according to the committee is N606.196 billion.

ADVERTISEMENT

ADVERTISEMENT

Customs Corner

Nigeria Customs Launches Advance Ruling System for Effective Trade Facilitation

Author: Muhammad Bashir.

The Nigeria Customs Service (NCS) has, in conjunction with the Nigerian Energy Support Programme (NESP), launched an auspicious scheme aimed at enhancing trade facilitation and creating a more transparent business environment for the Service’s stakeholders in trade space, named Advance Ruling.

Speaking at the venue of launching the project on Thursday, 2nd May 2024, at Envoy Avenue in Abuja, Comptroller-General of Customs Bashir Adewale Adeniyi described ‘Advanced Ruling’ as a critical mechanism that allows traders to obtain binding decisions from Customs administrations on the classification, origin, and valuation of goods before importation.

Appreciating the stakeholders and partners for gracing the event, CGC Adeniyi emphasised that the launched project will also serve as a tool for reducing compliance costs and fostering a conducive business environment for traders.

He said, “Today, we shall be taking the first step towards launching the Nigeria Customs Service Advance Ruling, starting with stakeholder engagement.”

The CGC, who recognised the significance of the project, as it aligns with the World Customs Organization (WCO) and the World Trade Organization (WTO), also emphasised its relevance in facilitating both domestic and international trade while also promoting Customs compliance.

“According to the WCO and the WTO, Advanced Ruling enhances predictability and transparency in customs procedures, streamlining trade processes and minimising delays, uncertainties, and costs associated with Customs clearance.” CGC Adeniyi added.

Commending President Bola Ahmed Tinubu for laying the ground to enhance the economy of Nigeria and supporting the Service, CGC Adeniyi emphasised that the launch of Advanced Ruling at this time aligns with the policy directive of President Tinubu’s administration to facilitate trade for legitimate traders.

He highlighted, “This is reflected in the Policy Advisory Document of the government, which signifies recent achievements, such as the approval to decongest the ports and make them free and accessible for importers and operators.”

As the Comptroller-General of Customs championed the laying of a foundation for Advance Ruling to enhance trade in Nigeria, he revealed that the Service has made all arrangements to conduct workshops and sensitisation sessions at Customs Area Commands to ensure that all stakeholders are well-informed and prepared to utilise this new mechanism effectively.

He, however, applauded the German International Cooperation Agency (GIZ) and other partners for their unwavering partnership and continued support of achieving a significant milestone in trade facilitation activities under the Nigeria Energy Support Programme.

“It is essential to acknowledge that initiatives like Advanced Ruling necessitate investments in capacity building for both officers and stakeholders. We are committed to leveraging our internal capacity while exploring collaboration opportunities with external partners like GIZ.” He said.

Customs Corner

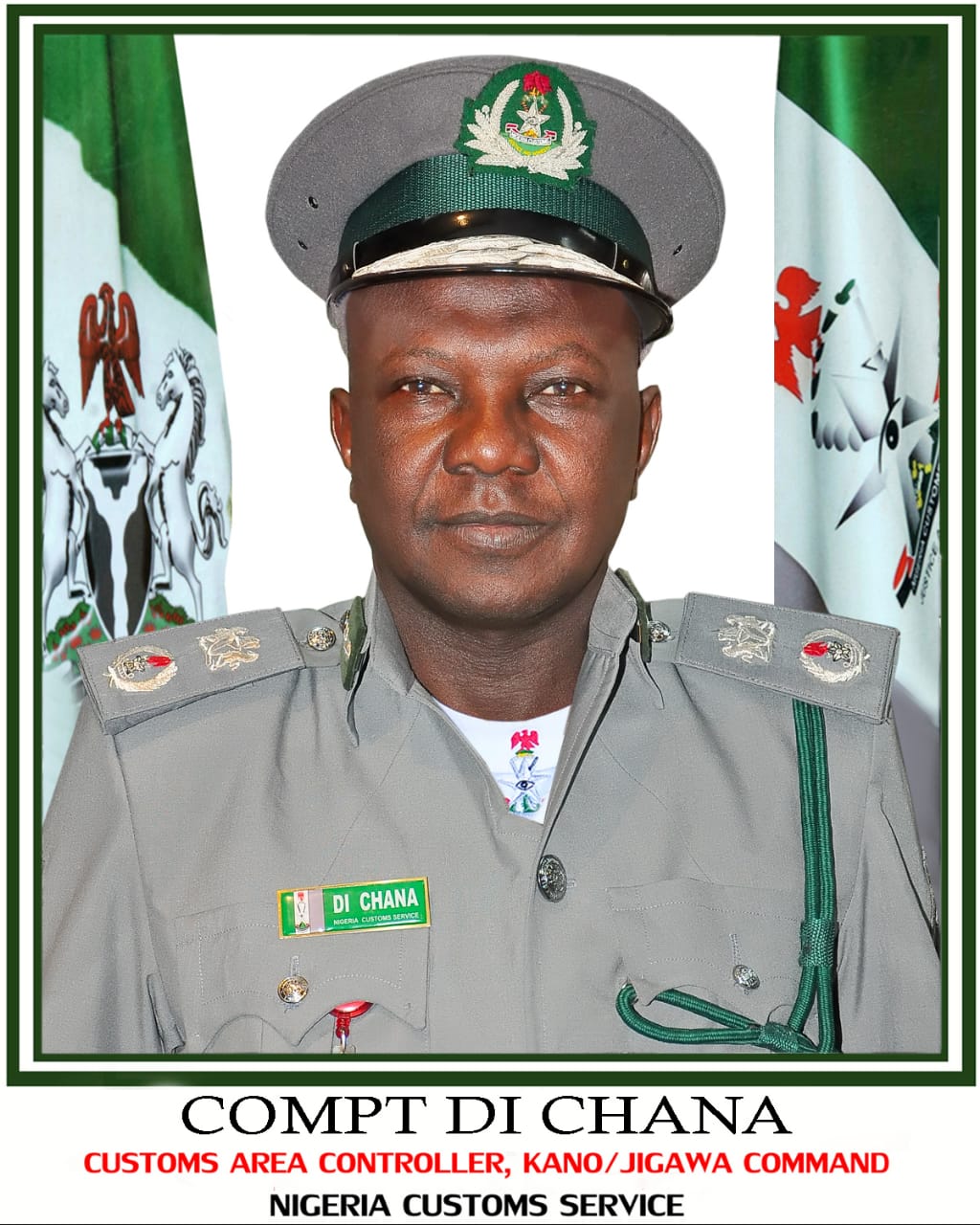

Comptroller Chana Re-echoes Commitment to Implementing Government Policies in Kano Free Zone

Author: Vivian Daniel.

The Customs Area Controller of Kano/Jigawa Command, Comptroller Dauda Chana, has reiterated the commitment of the Service to facilitate genuine trade without compromising government policy, especially as they affect special economic areas like the Kano Free Trade Zone.

This was conveyed in a press statement signed on 25 April 2024 by the Superintendent of Customs, Public Relations Officer of Kano/Jigawa Area Command, Saidu Nuraddeen.

The Customs Area Controller, Comptroller Dauda Chana, noted that the government revenue through the operations of the Kano Free Trade Zone is untrue and has strategically positioned Officers to ensure due diligence is carried out in the management of finished products within the zone or from any of the excise factories under its watch.

He stated that those who accused Officers and Men of the Nigeria Customs Service (NCS) of illegalities succeeded in displaying ignorance about the activities of the Service, especially in the areas of Duty, Import and Export processes and the laws guiding trade activities in the Free Trade Zones.

He further emphasised that the Kano/Jigawa Command recorded N613,369,204.81 between January and April 2024, as against N132,436,766.00 in 2023, which indicates an increase in revenue generation.

The CAC seized the opportunity to remind the general public that the Nigeria Export Processing Zones Authority (NEPZA) regulates the zone’s activities.

He added that unless there is an intention of exporting to Customs territory, NCS Officers do not interfere with the Zone as it ensures the prevention of smuggling and duty evasion within all its areas of jurisdiction. According to him, records are always taken for proper duty collection and calculation.

Comptroller Chana reminded that the NCS is not the only government organisation in the Zone while restating that the Command will stop at nothing to adhere strictly to the law and defined rules of engagement.

“In the Free Trade Zone, there are productions taking place, there are manufacturing taking place, and the end product of all these are finished products, and for these to go out, duties are paid.” The CAC noted.

“It is also good for the public to know that goods or raw materials locally sourced are duty-free as well as exportation,” he stated.

The CAC gave more insight into the processes involved during the clearance of goods while exonerating the Officers and Men of the Service of any allegations of connivance with business owners.

“Let it also be on record that the process of clearance involves many stages, and we even have a unit domiciled in every Command that checks after clearance of goods cleared for anomalies, so no officer can connive because the documents are all intact to show what transpired. This makes the allegation of compromise baseless,” he opined.

Customs Corner

JBPT Sector 2 Records Seizures Worth N1.6 Billion Within Six Months

Author: Abass Quadri.

The Joint Border Patrol Team (JBPT) Sector 2, Southwest Zone, has recorded seizures of illegal goods, with a Duty Paid Value of N1.6 billion.

Deputy Comptroller Mohammed Shuaibu in charge of JBPT Sector 2, availed the team’s activities under his stewardship in a press briefing held at Abeokuta on Wednesday, 24 April 2024.

The coordinator noted that the team’s area of responsibilities, which covers all six southwestern states, is mandated to “curbing anti-smuggling activities, channelling of procedures, and combating other cross border crimes that threaten Nigeria’s national and economic security.

“The sector wishes to announce the seizures of illegal goods, which include Cannabis Sativa, secondhand clothings, and means of conveyance smuggled into the country with a Duty Paid Value of N1,663,646,360 and petroleum products valued at N52,486,215 which were auctioned out due to their inflammable nature.”

According to him, the seized goods were recorded between November 2023 and April 2024, adding that “no fewer than 15 suspects were arrested with some charged to court and others prosecuted”.

Handing over the seized Cannabis Sativa at Ogun II Command to the representative of the National Drug Law Enforcement Agency (NDLEA), Deputy Commandant Narcotics Ogun state, Nnyigide Alexander, DC Shuaibu commended the dedication, doggedness and professionalism of officers involved in the interception of the substances which would have caused more security threat.

On revenue generation, the border drill coordinator stated that N36,318,727 was generated through the issuance of Demand Notices (DN) on vehicles and other goods improperly imported into the country.

Receiving the seized Cannabis Sativa, DC Alexander thanked Shuaibu for his hard work, adding that this synergy fulfils the existing Memorandum of Understanding (MOU) between NCS and NDLEA.

In his words, “I feel highly happy that we are doing what we call sister agency collaboration, which has led to the result we have here. I expect to see more in the future because I know they are capable.”

Similarly, DC Shuaibu, who was also on a working visit to Seme and Ogun 1, Idiroko Area Commands, also handed over seized Cannabis Sativa to representatives of the NDLEA at Seme.

-

Revenue Streams3 years ago

Revenue Streams3 years agoCommunication Ministry Gives Zero Allocation to Nipost Out of N137.2billion Capital Votes

-

Customs Corner2 years ago

Customs Corner2 years agoCustoms Emerges Champions of 2022, Male, Female National Volleyball Super Cup

-

Newsroom4 years ago

Newsroom4 years agoNNPC Blames #EndSARS Protests, As Fuel Queues Return

-

ICT5 years ago

ICT5 years agoFinally! Huawei Launched Harmony OS | Let the Rivalry Begins with AndrodOS

-

Naija News6 years ago

Naija News6 years agoINEC registers 23 new political parties. YES, RAP, UP, 20 other parties

-

COVID-194 years ago

COVID-194 years agoVaccine Trials Starts Round The World: All You Need to Know

-

Customs Corner3 years ago

Customs Corner3 years agoArea Controller, Murtala Muhammed International Airport Command Passes On

-

Foreign2 years ago

Foreign2 years agoPhilippines’ Duterte Blocks Bill to Register Social Media Users