Finance

Nigerian Banks Commence Implementation of New Cheque Policy

Nigerian banks have declared the commencement of a new cheque policy set in motion by a Central Bank of Nigeria (CBN) directive, that demands the incorporation of a standardised new digit on the magnetic ink character recognition code line and expiry dates on cheque books.

Cheques in the old and the new formats have been simultaneously accepted for some time now but only those which complies with the new standardisation principles will henceforth be honoured for clearing.

Nigerian banks on Sunday announced the execution of the new cheque policy, with United Bank for Africa disclosing in a note to customers that the procedure aimed at boosting security of cheque transactions via the security of the settlement process through safer and quicker cheque processing.

The new features comprise narrower and longer columns for payee and amount in words, according to the lender.

The new cheque policy also requires the dateline to appear in the sequence of day followed by month, and then year on the cheque leaves.

Amount in figures, which previously appeared under date, now comes below amount in words.

The signature line has moved from under the column for amount in words to the space beneath amount in figure, while the control number has been increased from 8 digits to 10 and moved to the top right corner of the cheque.

Tier 1 lender First Bank of Nigeria Limited similarly acknowledged the starting if the new cheque policy just like a number of other banks.

To achieve a seamless implementation of the new cheque policy, the apex bank has stated its determination to create a friendly ambience and for cheque processing and other paper instruments through improved infrastructures.

Incase You Missed:

Swift Payment: CBN Orders Banks to Comply

EndSARS Campaigners Head to Court Seeking Unfreezing of Account

Nigerian Government Rules out New Tax, Increment in 2021

ADVERTISEMENT

ADVERTISEMENT

Customs Corner

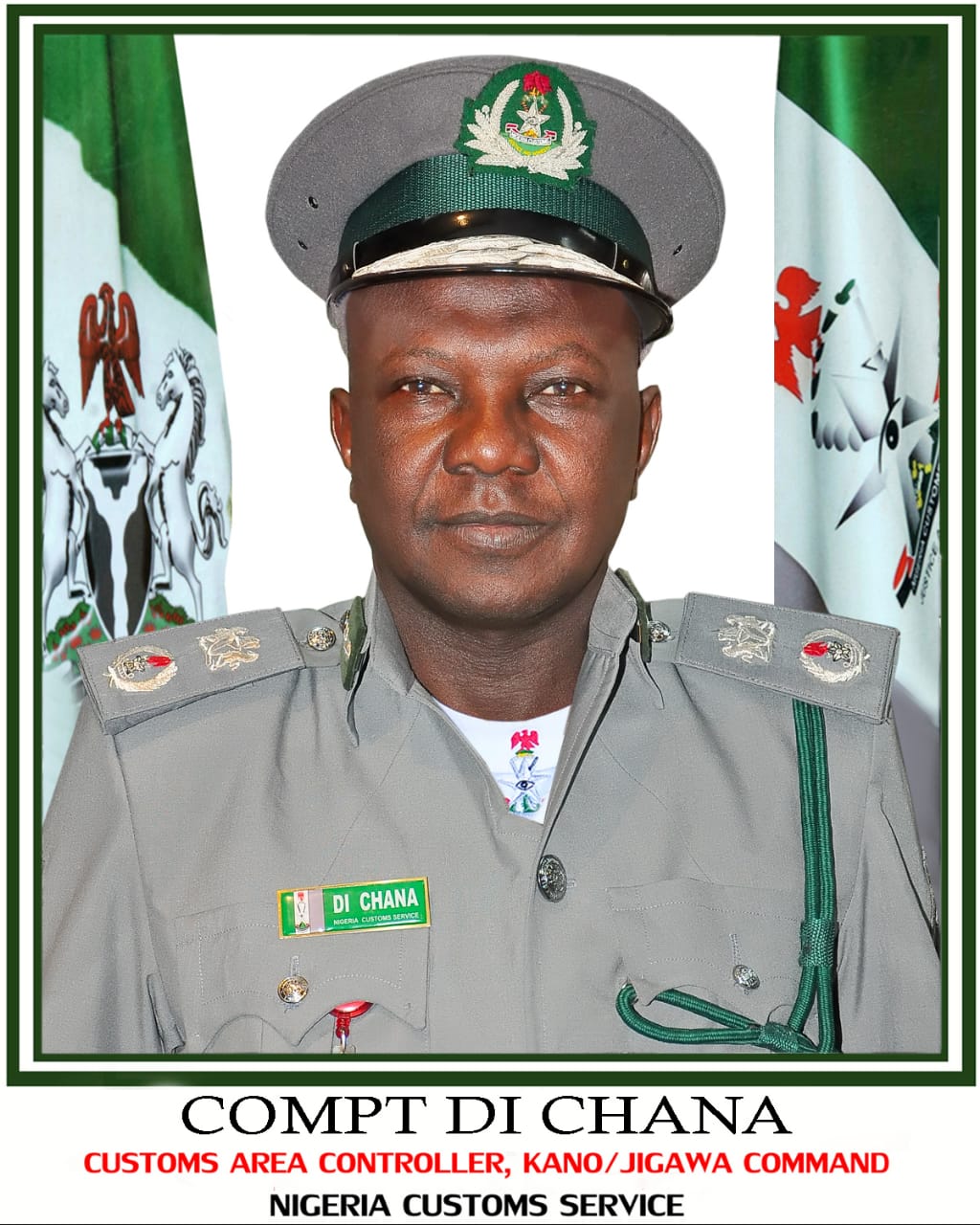

Comptroller Chana Re-echoes Commitment to Implementing Government Policies in Kano Free Zone

Author: Vivian Daniel.

The Customs Area Controller of Kano/Jigawa Command, Comptroller Dauda Chana, has reiterated the commitment of the Service to facilitate genuine trade without compromising government policy, especially as they affect special economic areas like the Kano Free Trade Zone.

This was conveyed in a press statement signed on 25 April 2024 by the Superintendent of Customs, Public Relations Officer of Kano/Jigawa Area Command, Saidu Nuraddeen.

The Customs Area Controller, Comptroller Dauda Chana, noted that the government revenue through the operations of the Kano Free Trade Zone is untrue and has strategically positioned Officers to ensure due diligence is carried out in the management of finished products within the zone or from any of the excise factories under its watch.

He stated that those who accused Officers and Men of the Nigeria Customs Service (NCS) of illegalities succeeded in displaying ignorance about the activities of the Service, especially in the areas of Duty, Import and Export processes and the laws guiding trade activities in the Free Trade Zones.

He further emphasised that the Kano/Jigawa Command recorded N613,369,204.81 between January and April 2024, as against N132,436,766.00 in 2023, which indicates an increase in revenue generation.

The CAC seized the opportunity to remind the general public that the Nigeria Export Processing Zones Authority (NEPZA) regulates the zone’s activities.

He added that unless there is an intention of exporting to Customs territory, NCS Officers do not interfere with the Zone as it ensures the prevention of smuggling and duty evasion within all its areas of jurisdiction. According to him, records are always taken for proper duty collection and calculation.

Comptroller Chana reminded that the NCS is not the only government organisation in the Zone while restating that the Command will stop at nothing to adhere strictly to the law and defined rules of engagement.

“In the Free Trade Zone, there are productions taking place, there are manufacturing taking place, and the end product of all these are finished products, and for these to go out, duties are paid.” The CAC noted.

“It is also good for the public to know that goods or raw materials locally sourced are duty-free as well as exportation,” he stated.

The CAC gave more insight into the processes involved during the clearance of goods while exonerating the Officers and Men of the Service of any allegations of connivance with business owners.

“Let it also be on record that the process of clearance involves many stages, and we even have a unit domiciled in every Command that checks after clearance of goods cleared for anomalies, so no officer can connive because the documents are all intact to show what transpired. This makes the allegation of compromise baseless,” he opined.

Customs Corner

JBPT Sector 2 Records Seizures Worth N1.6 Billion Within Six Months

Author: Abass Quadri.

The Joint Border Patrol Team (JBPT) Sector 2, Southwest Zone, has recorded seizures of illegal goods, with a Duty Paid Value of N1.6 billion.

Deputy Comptroller Mohammed Shuaibu in charge of JBPT Sector 2, availed the team’s activities under his stewardship in a press briefing held at Abeokuta on Wednesday, 24 April 2024.

The coordinator noted that the team’s area of responsibilities, which covers all six southwestern states, is mandated to “curbing anti-smuggling activities, channelling of procedures, and combating other cross border crimes that threaten Nigeria’s national and economic security.

“The sector wishes to announce the seizures of illegal goods, which include Cannabis Sativa, secondhand clothings, and means of conveyance smuggled into the country with a Duty Paid Value of N1,663,646,360 and petroleum products valued at N52,486,215 which were auctioned out due to their inflammable nature.”

According to him, the seized goods were recorded between November 2023 and April 2024, adding that “no fewer than 15 suspects were arrested with some charged to court and others prosecuted”.

Handing over the seized Cannabis Sativa at Ogun II Command to the representative of the National Drug Law Enforcement Agency (NDLEA), Deputy Commandant Narcotics Ogun state, Nnyigide Alexander, DC Shuaibu commended the dedication, doggedness and professionalism of officers involved in the interception of the substances which would have caused more security threat.

On revenue generation, the border drill coordinator stated that N36,318,727 was generated through the issuance of Demand Notices (DN) on vehicles and other goods improperly imported into the country.

Receiving the seized Cannabis Sativa, DC Alexander thanked Shuaibu for his hard work, adding that this synergy fulfils the existing Memorandum of Understanding (MOU) between NCS and NDLEA.

In his words, “I feel highly happy that we are doing what we call sister agency collaboration, which has led to the result we have here. I expect to see more in the future because I know they are capable.”

Similarly, DC Shuaibu, who was also on a working visit to Seme and Ogun 1, Idiroko Area Commands, also handed over seized Cannabis Sativa to representatives of the NDLEA at Seme.

Customs Corner

Nigeria Customs Service Reaffirms Commitment to Gender Equality in Decision-Making

Author: Bashir Muhammad.

The Nigeria Customs Service (NCS) has reiterated its dedication to promoting gender equality in decision-making processes as part of its efforts to combat gender discrimination and gender-based violence.

At a capacity-building workshop on gender inclusivity, co-organized by the World Customs Organization (WCO) and the NCS in Abuja on Monday, April 22, 2024, the Comptroller-General of Customs, Bashir Adewale Adeniyi, reaffirmed his commitment to fostering a gender-inclusive environment within the service.

Acting Deputy Comptroller-General of Customs, Caroline Niagwan, represented the CGC at the event, where she emphasised the need for clear policies and procedures to address gender discrimination, harassment, and biases within the NCS.

“Our aim is to create a workplace where everyone has equal opportunities to grow and contribute to the service’s success, regardless of gender,” the CGC said. “We are committed to addressing gender discrimination, harassment, and biases within our ranks, and we will work tirelessly to ensure that our policies and practices reflect this commitment.”

The workshop brought together customs officials, gender experts, and stakeholders to discuss strategies for promoting gender inclusivity and addressing gender-based violence in the workplace.

With this reaffirmed commitment, the NCS demonstrates its dedication to creating a more inclusive and equitable work environment where all employees can thrive and reach their full potential.

-

Revenue Streams2 years ago

Revenue Streams2 years agoCommunication Ministry Gives Zero Allocation to Nipost Out of N137.2billion Capital Votes

-

Customs Corner2 years ago

Customs Corner2 years agoCustoms Emerges Champions of 2022, Male, Female National Volleyball Super Cup

-

Newsroom4 years ago

Newsroom4 years agoNNPC Blames #EndSARS Protests, As Fuel Queues Return

-

ICT5 years ago

ICT5 years agoFinally! Huawei Launched Harmony OS | Let the Rivalry Begins with AndrodOS

-

Naija News6 years ago

Naija News6 years agoINEC registers 23 new political parties. YES, RAP, UP, 20 other parties

-

COVID-194 years ago

COVID-194 years agoVaccine Trials Starts Round The World: All You Need to Know

-

Customs Corner3 years ago

Customs Corner3 years agoArea Controller, Murtala Muhammed International Airport Command Passes On

-

Foreign2 years ago

Foreign2 years agoPhilippines’ Duterte Blocks Bill to Register Social Media Users