Customs Corner

VIN Valuation, The Uncomfortable Truth

Author: Gift Wada, Abuja

A cursory review of online, print newspapers and journals focused on maritime related issues reveal certain curiosities among a few freight forwarding practitioners and clearing agents. In this peculiar group of individuals will be found those who demand the automation of Customs processes but still insist on human interference. They demand standardisation but prefer randomized values. They demand simplification of trade processes but prefer a little complication here and there. For this lot the contradictions in their demands makes sense so long as it translates to the payment of the least tax to government. Their propensity to give advice but not to take it smacks of hypocrisy and should be called out by well meaning Nigerians.

In recent times the concensus among clearing agents on the valuation of used vehicles appear to favour a harmonized value system that is consistent across all Customs platforms in Nigeria. They insisted that the same make, and model of cars should be made to pay the same amount of duty. These agents also demanded the discontinuation of the discounted value method which allowed for the subjective considerations of officers in the Customs Valuation Unit who rely mainly on the book value of vehicles discounted at a fixed rate over time.

In 2022 their prayers have been answered. NCS introduced VIN- Valuation as a fully automated tool devoid of human interference, capable of aggregating values from countries of export, consistent in make and model of cars for the purpose of assessing duty. This system uses Artificial Intelligence (AI) to pull together trade data representing a range of values consistent for each car make and model using the Vehicle Identity Number (VIN). It is totally devoid of human inputs by NCS officers, and enables easy and fast assessments necessary to process duty payments. Indeed time motion studies confirm a maximum of 6 hours between automated assessments and release of cars using VIN-Valuation.

Before the introduction of this tool, town hall meetings were held across the country stating its benefits, one of the greatest being trade facilitation. Following the demands of agents for a simplified system which recognises standard values, NCS was confident that this innovation in its clearing process will satisfy the desires of agents clamouring for change. The resistance to VIN-Valuation therefore comes as a surprise seeing that it was deliberately designed to meet their demands. It also compels us to investigate further the intentions of those protesting its use. When our Valuation officers gave out ex-factory prices for duty assessment they were accused of collecting monetary inducements to give lower values. It will be interesting to know what these same agents/importers will accuse the machines of. Maybe this time it will be machine discrimination, or discrimination based on non digital considerations.

Comptroller Abubakar Umar Takes Over Leadership Of Customs Western Marine Command

The truth is that most of the individuals protesting the introduction of VIN-Valuation do not care about automation, simplification, harmonisation or even transparency in the system. They do not care about the wellbeing of the country or the industry they claim to represent. All they care about are the personal benefits accruable from milking the system. They want to pay as little import duty as possible and keep the chunk of the monies for themselves. These persons advocate chaos rather than order. They thrive in wheeling, dealing environments where the price of everything is negotiable.

NCS under the able leadership of Col. Hameed Ibrahim Ali (Rtd) is poised to rewrite history by reinventing Customs operations in its entirety. The vision of this administration is to create environments conducive for facilitating trade that is consistent and predictable with little to non human interference. VIN-Valuation is only one in a series of innovations designed for this purpose. The earlier agents and importers come to terms with this reality the better it will be for everyone.

NCS therefore urges well meaning Nigerians to embrace the electronic services that are being put at their disposal. Importers who have valid Tax Identity Numbers (TIN) can do self assessment and pay duty by themselves. We implore licensed Customs agents to also be honest in their declarations as it will go a long way in expediting the release of their goods out of Customs control.

Read Also:

APFFLON’s Unfair Criticism Of NAFDAC

Comptroller Mohammed Dansakawa Takes Over North Eastern Marine Command

ADVERTISEMENT

ADVERTISEMENT

Customs Corner

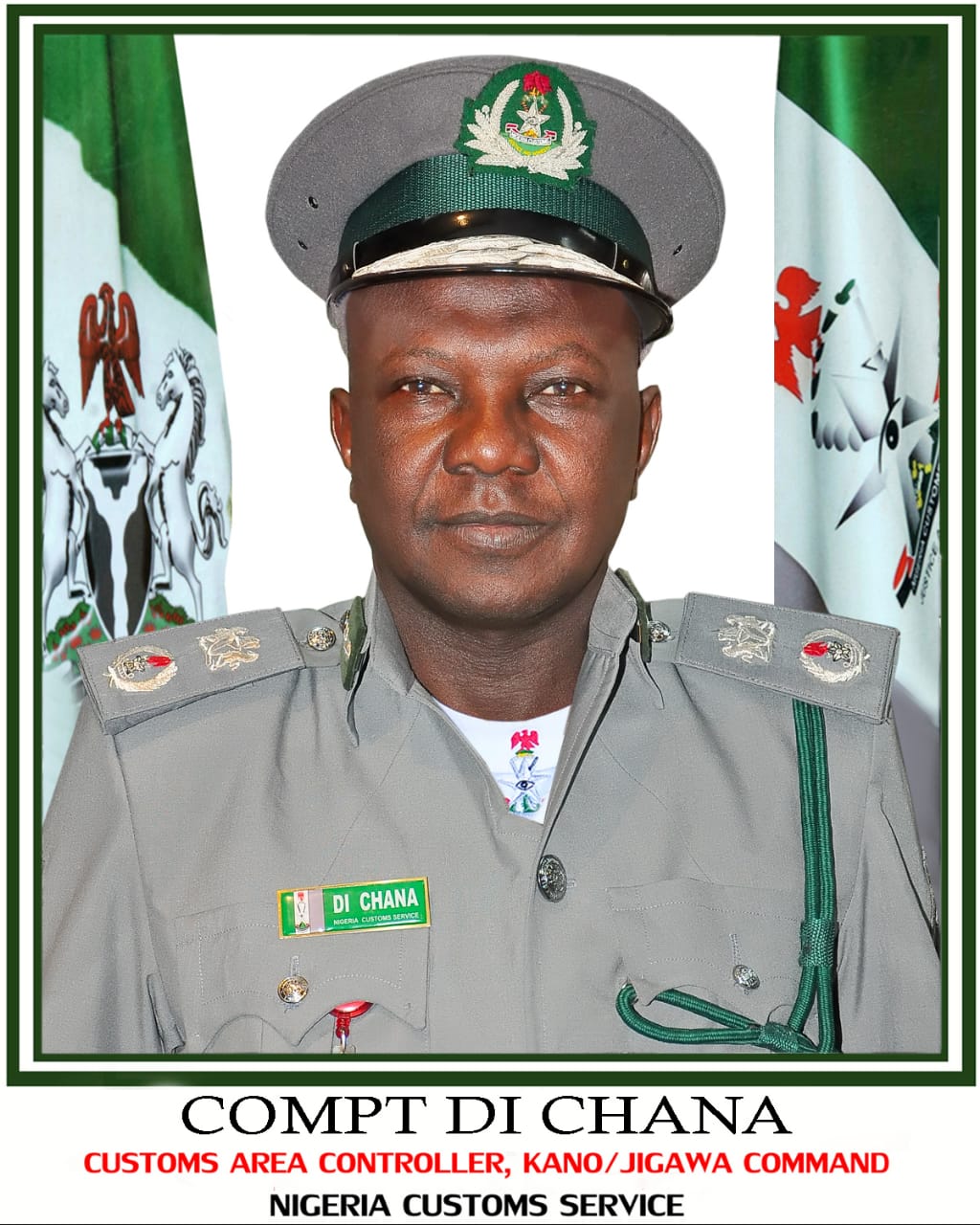

Comptroller Chana Re-echoes Commitment to Implementing Government Policies in Kano Free Zone

Author: Vivian Daniel.

The Customs Area Controller of Kano/Jigawa Command, Comptroller Dauda Chana, has reiterated the commitment of the Service to facilitate genuine trade without compromising government policy, especially as they affect special economic areas like the Kano Free Trade Zone.

This was conveyed in a press statement signed on 25 April 2024 by the Superintendent of Customs, Public Relations Officer of Kano/Jigawa Area Command, Saidu Nuraddeen.

The Customs Area Controller, Comptroller Dauda Chana, noted that the government revenue through the operations of the Kano Free Trade Zone is untrue and has strategically positioned Officers to ensure due diligence is carried out in the management of finished products within the zone or from any of the excise factories under its watch.

He stated that those who accused Officers and Men of the Nigeria Customs Service (NCS) of illegalities succeeded in displaying ignorance about the activities of the Service, especially in the areas of Duty, Import and Export processes and the laws guiding trade activities in the Free Trade Zones.

He further emphasised that the Kano/Jigawa Command recorded N613,369,204.81 between January and April 2024, as against N132,436,766.00 in 2023, which indicates an increase in revenue generation.

The CAC seized the opportunity to remind the general public that the Nigeria Export Processing Zones Authority (NEPZA) regulates the zone’s activities.

He added that unless there is an intention of exporting to Customs territory, NCS Officers do not interfere with the Zone as it ensures the prevention of smuggling and duty evasion within all its areas of jurisdiction. According to him, records are always taken for proper duty collection and calculation.

Comptroller Chana reminded that the NCS is not the only government organisation in the Zone while restating that the Command will stop at nothing to adhere strictly to the law and defined rules of engagement.

“In the Free Trade Zone, there are productions taking place, there are manufacturing taking place, and the end product of all these are finished products, and for these to go out, duties are paid.” The CAC noted.

“It is also good for the public to know that goods or raw materials locally sourced are duty-free as well as exportation,” he stated.

The CAC gave more insight into the processes involved during the clearance of goods while exonerating the Officers and Men of the Service of any allegations of connivance with business owners.

“Let it also be on record that the process of clearance involves many stages, and we even have a unit domiciled in every Command that checks after clearance of goods cleared for anomalies, so no officer can connive because the documents are all intact to show what transpired. This makes the allegation of compromise baseless,” he opined.

Customs Corner

JBPT Sector 2 Records Seizures Worth N1.6 Billion Within Six Months

Author: Abass Quadri.

The Joint Border Patrol Team (JBPT) Sector 2, Southwest Zone, has recorded seizures of illegal goods, with a Duty Paid Value of N1.6 billion.

Deputy Comptroller Mohammed Shuaibu in charge of JBPT Sector 2, availed the team’s activities under his stewardship in a press briefing held at Abeokuta on Wednesday, 24 April 2024.

The coordinator noted that the team’s area of responsibilities, which covers all six southwestern states, is mandated to “curbing anti-smuggling activities, channelling of procedures, and combating other cross border crimes that threaten Nigeria’s national and economic security.

“The sector wishes to announce the seizures of illegal goods, which include Cannabis Sativa, secondhand clothings, and means of conveyance smuggled into the country with a Duty Paid Value of N1,663,646,360 and petroleum products valued at N52,486,215 which were auctioned out due to their inflammable nature.”

According to him, the seized goods were recorded between November 2023 and April 2024, adding that “no fewer than 15 suspects were arrested with some charged to court and others prosecuted”.

Handing over the seized Cannabis Sativa at Ogun II Command to the representative of the National Drug Law Enforcement Agency (NDLEA), Deputy Commandant Narcotics Ogun state, Nnyigide Alexander, DC Shuaibu commended the dedication, doggedness and professionalism of officers involved in the interception of the substances which would have caused more security threat.

On revenue generation, the border drill coordinator stated that N36,318,727 was generated through the issuance of Demand Notices (DN) on vehicles and other goods improperly imported into the country.

Receiving the seized Cannabis Sativa, DC Alexander thanked Shuaibu for his hard work, adding that this synergy fulfils the existing Memorandum of Understanding (MOU) between NCS and NDLEA.

In his words, “I feel highly happy that we are doing what we call sister agency collaboration, which has led to the result we have here. I expect to see more in the future because I know they are capable.”

Similarly, DC Shuaibu, who was also on a working visit to Seme and Ogun 1, Idiroko Area Commands, also handed over seized Cannabis Sativa to representatives of the NDLEA at Seme.

Customs Corner

Customs Sensitise Retired Senior Officers on Automated Retiree Verification System

By Muhammad Bashir

The Nigeria Customs Service (NCS) commenced the sensitisation program on Monday, 22 April, 2024, for the enrollment of an automated retiree verification system for high-ranking officers who have retired from the Service.

The programme, the first of its kind, was designed to serve as a platform through which all retired Deputy Comptroller Generals (DCGs), Assistant Comptroller Generals (ACGs), and Comptrollers could be electronically verified to modernise the analogue process of benefits application for retired officers.

Addressing the retirees at the Customs Headquarters in Abuja, the Comptroller-General of Customs, Bashir Adeniyi, represented by Deputy Comptroller-General of Customs (DCG) in-charge of Finance Administration & Technical Service, Festus Okun, described the initiative as timely and assured them of a seamless verification exercise.

He said, “Esteemed retirees, it is with great honour that I address you today on behalf of the Comptroller-General of Customs, Bashir Adewale Adeniyi. This initiative to engage in a seamless verification exercise is timely and proof of the service’s commitment to ensuring your welfare and well-being after years of dedicated service to the Customs Service.”

“We understand the importance of this verification process in ensuring that you receive the benefits and entitlements you rightly deserve. Rest assured, we are dedicated to making this process as smooth and efficient as possible, with the utmost transparency and accountability.

“As Deputy Comptroller-General of Customs overseeing Finance Administration & Technical Service, I assure you that your concerns and needs are our top priority. We value your contributions to the Customs, and we are committed to supporting you in every possible way as you transition into retirement. Thank you for your service, and we look forward to assisting you through this verification process.”

During the verification exercise, some retired officers who voiced their feedback applauded the initiative, stating, “This positive reception emphasises the significance of this endeavour in streamlining access to benefits and entitlements, reaffirming the dedication to serving retirees with the utmost care and diligence.”

-

Revenue Streams2 years ago

Revenue Streams2 years agoCommunication Ministry Gives Zero Allocation to Nipost Out of N137.2billion Capital Votes

-

Customs Corner2 years ago

Customs Corner2 years agoCustoms Emerges Champions of 2022, Male, Female National Volleyball Super Cup

-

Newsroom4 years ago

Newsroom4 years agoNNPC Blames #EndSARS Protests, As Fuel Queues Return

-

ICT5 years ago

ICT5 years agoFinally! Huawei Launched Harmony OS | Let the Rivalry Begins with AndrodOS

-

Naija News6 years ago

Naija News6 years agoINEC registers 23 new political parties. YES, RAP, UP, 20 other parties

-

COVID-194 years ago

COVID-194 years agoVaccine Trials Starts Round The World: All You Need to Know

-

Customs Corner3 years ago

Customs Corner3 years agoArea Controller, Murtala Muhammed International Airport Command Passes On

-

Foreign2 years ago

Foreign2 years agoPhilippines’ Duterte Blocks Bill to Register Social Media Users